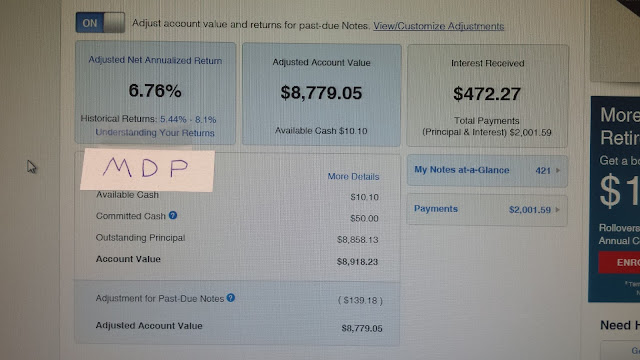

Once again, I am a little late posting this update. These numbers reflect yesterday's balances and interest payments received. Pretty boring and consistent which I like.

I have been investing $25 at a time and now have 421 notes up from 375 notes last report. I am continuing to use the automated note selecting mechanism which lets the computer spread the capital across a variety different loan grades.

Right now as you can see above, my current return is 6.76% after all defaults and past due loans have been written down.This return continues to closely mirror the predicted 6.68% return under the Platform Mix. Also, my monthly payments have increased to approximately $328.

As my loan portfolio continues to increase both in value and number of notes outstanding, my returns are becoming less volatile and a bit more predictable. It looks like I will be in the 6-7%.

In the early months, I have seen the returns as high as 9% and as low as 3%. I'll be more than satified at the 7% level. That is what could be expected from a typical REIT and slightly higher than most utilities.

I will continue to invest $200 a week until I reached $10,000. At that point I will probably continue investing new capital, but may stick with higher credit borrowers.

2016 Net Annualized Returns

July --- 6.77%

August --- 6.33%

September --- 6.65%

October --- 6.76%

DEFY MEDIOCRITY

MDP -

ReplyDeleteThat's solid income generation, that's for sure. Still mad that Ohio does not allow us to do this. Keep it up, love the article share.

-Lanny

Lanny,

DeleteMultiple streams!!! It's a good thing. Keep pumping up those dividends over on your side of the pond!

MDP